nebraska sales tax rate 2020

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with. The base state sales tax rate in Nebraska is 55.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Average Sales Tax With Local.

. FilePay Your Return. The minimum combined 2022 sales tax rate for Omaha Nebraska is. 30 rows Nebraska NE Sales Tax Rates by City.

Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up. The state sales tax rate in Nebraska is 5500. Nebraska has a statewide sales tax rate of 55 which has been in place since 1967.

The base state sales tax rate in Nebraska is 55. 536 rows Nebraska Sales Tax55. With local taxes the total sales tax rate is between 5500 and 8000.

The state sales tax rate in Nebraska is 5500. Municipal governments in Nebraska are also allowed to collect a local-option sales tax that ranges from. The Nebraska state sales and use tax rate is 55 055.

This is the total of state county and city sales tax rates. Dakota County1 05 60 06 134-922 043 Gage County205 60 06 245-934067. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022.

Ad Keep up with changing tax laws. County Sales and Use Tax Rates. The Nebraska NE state sales tax rate is currently 55.

There are a total of 334 local tax jurisdictions across the. Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75. This is the total of state county and city sales tax rates.

The minimum combined 2022 sales tax rate for Nebraska City Nebraska is. Exemptions to the Nebraska sales tax will vary by state. What is the sales tax rate in Omaha Nebraska.

City Local Total Rate Local FIPS or Village Rate. The Nebraska State Nebraska sales tax is 550 the same as the Nebraska state sales tax. Local Sales and Use Tax Rates Effective July 1 2020 Dakota County and Gage County each impose a tax rate of 05.

See the County Sales and Use Tax Rates section at the. While many other states allow counties and other localities to collect a local option sales tax. What is the sales tax rate in Nebraska City Nebraska.

The minimum combined 2022 sales tax rate for Lincoln Nebraska is. Waste Reduction and Recycling Fee. Find your Nebraska combined state.

Sales and Use Taxes. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average. The Nebraska sales tax rate is 55 as of 2022 with some cities and counties adding a local sales tax on top of the NE state sales tax.

See the County Sales and Use Tax Rates section at the. Sales Tax Rate Finder. What is the sales tax rate in Lincoln Nebraska.

Local Sales and Use Tax Rates Effective April 1 2020 Dakota County and Gage County each impose a tax rate of 05. Maximum Possible Sales Tax. This is the total of state county and city sales tax rates.

The Nebraska state sales and use tax rate is 55 055. Average Local State Sales Tax. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt.

Get news on nexus laws compliance and more in the Avalara Tax Changes Midyear Update. Get the Avalara Tax Changes Midyear Update today.

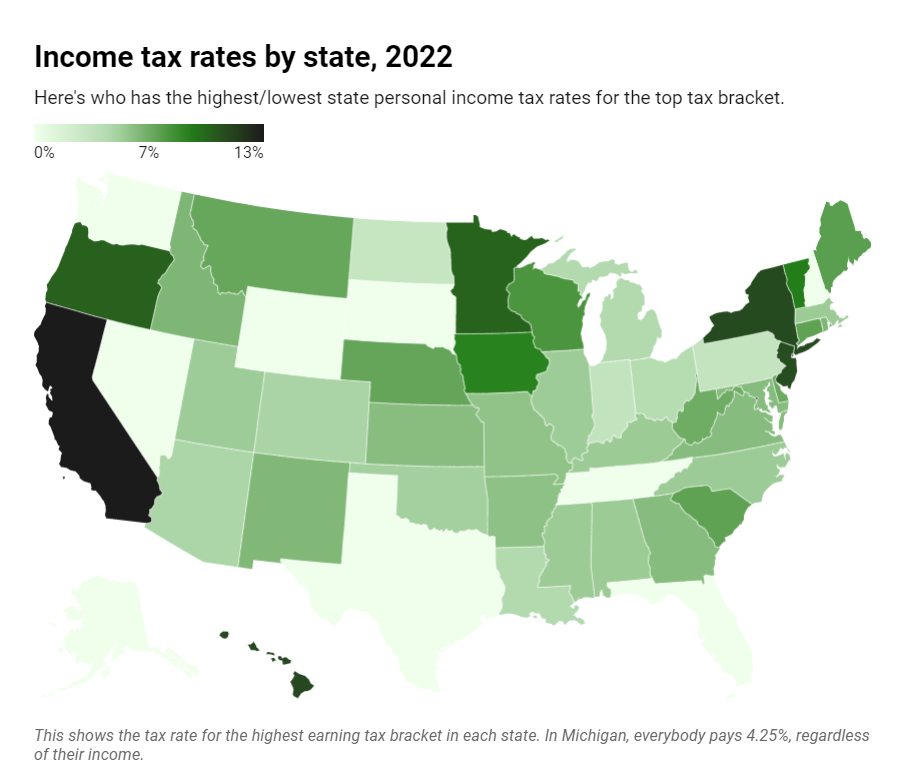

/images/2022/01/18/individual-tax-rates-by-state.png)

Here Are The States Where Tax Filers Are Paying The Highest Percentage Of Their Income Financebuzz

How To Register For A Sales Tax Permit Taxjar

2022 Property Taxes By State Report Propertyshark

State Corporate Income Tax Rates And Brackets Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

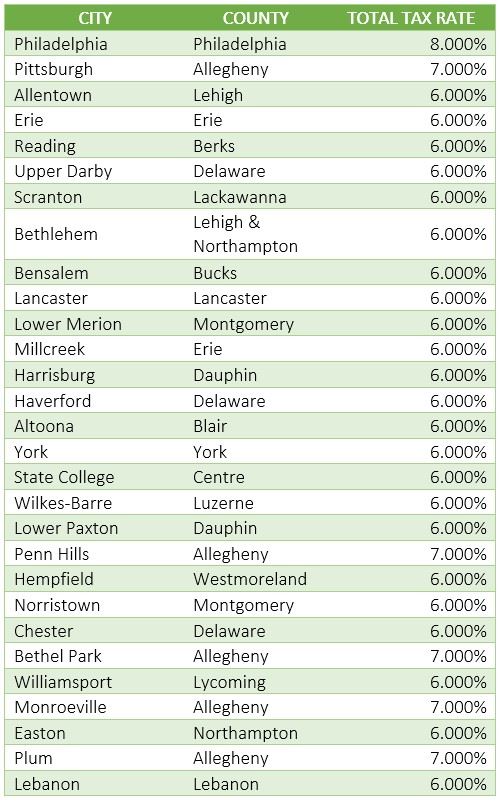

Pennsylvania Sales Tax Guide For Businesses

State Corporate Income Tax Rates And Brackets Tax Foundation

Nebraska Sales Use Tax Guide Avalara

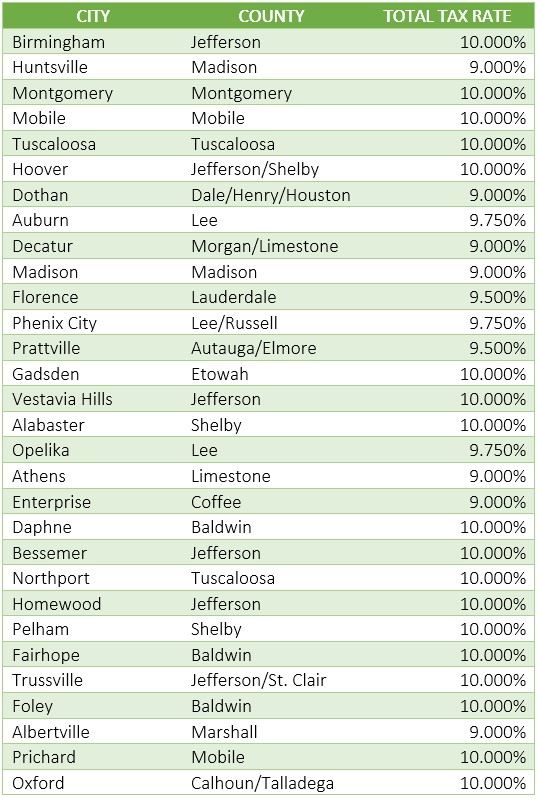

Alabama Sales Tax Guide For Businesses

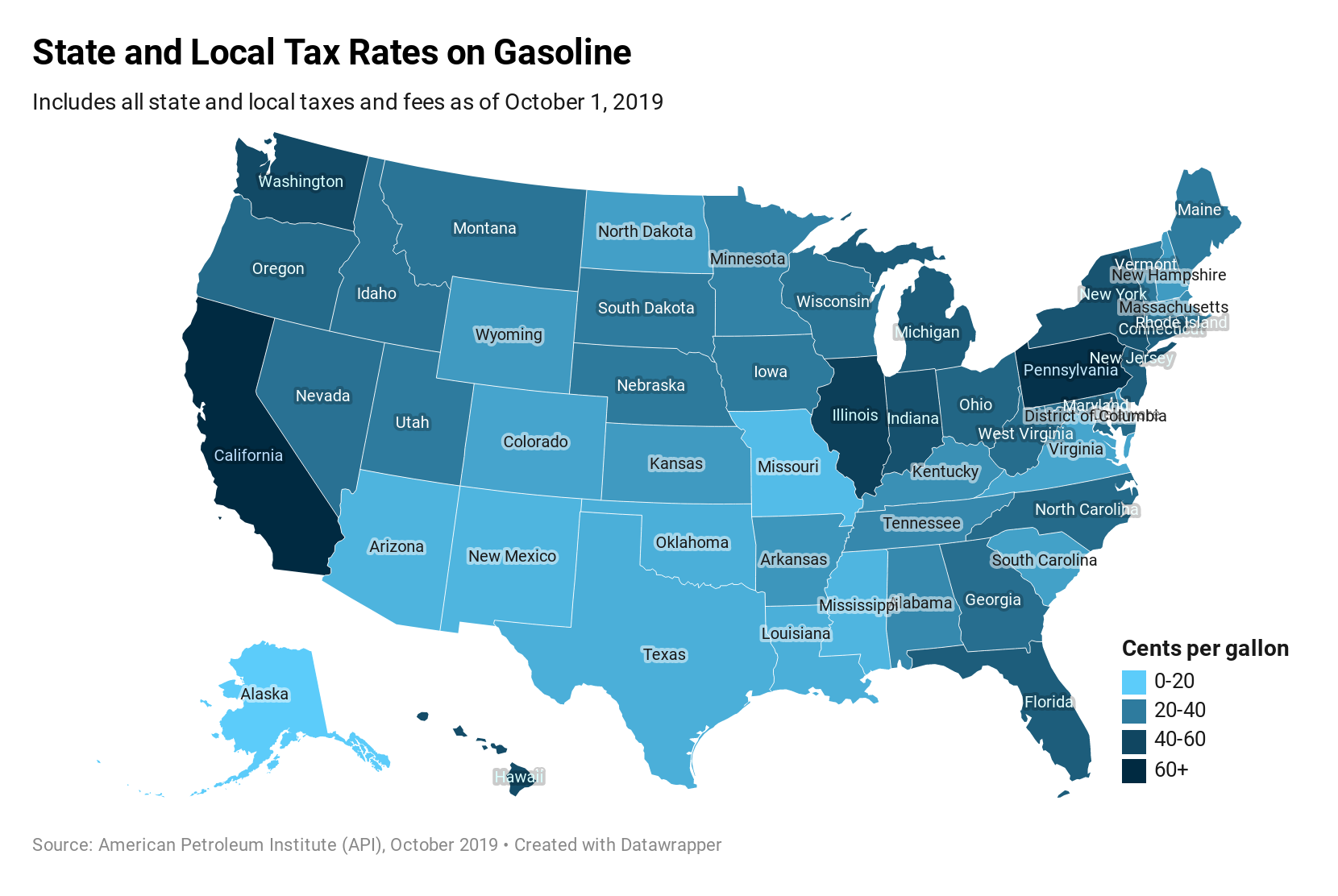

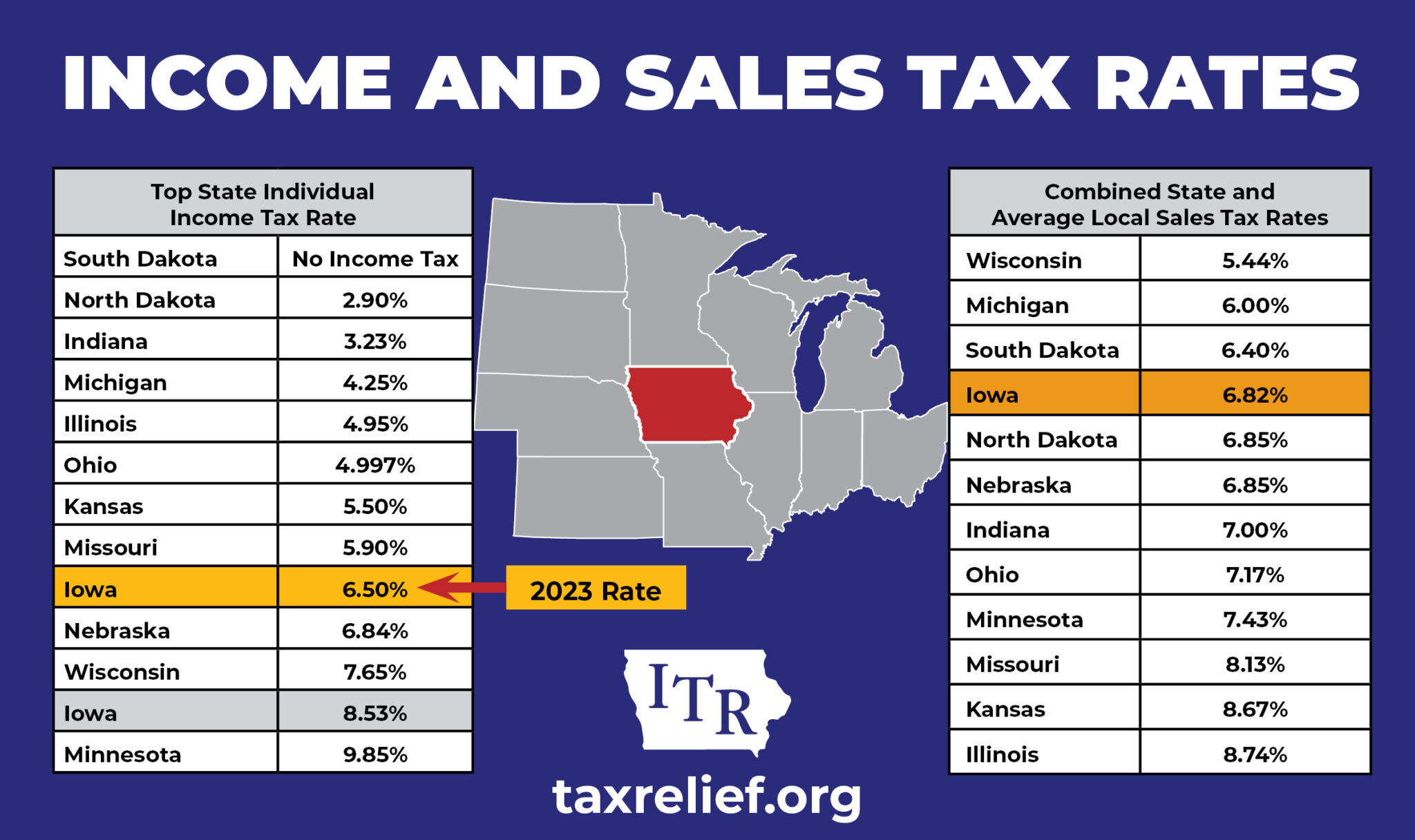

Midwest State Income And Sales Tax Rates Iowans For Tax Relief

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Sales Tax On Grocery Items Taxjar

Indiana Income Tax Rate And Brackets 2019

Learn More About The Massachusetts State Tax Rate H R Block

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map